Ordolixe is all about the personal development of the average person. We bring suitable investment education to users. We don’t teach but connect users with investment education firms. These firms equip people with comprehensive investment knowledge through a broad learning process.

As people learn, they receive intellectual awakening, financial knowledge, and insights into investment-related issues and the investment industry. Ordolixe makes it easy for anyone to attain financial enlightenment by promptly assigning them to investment education firms.

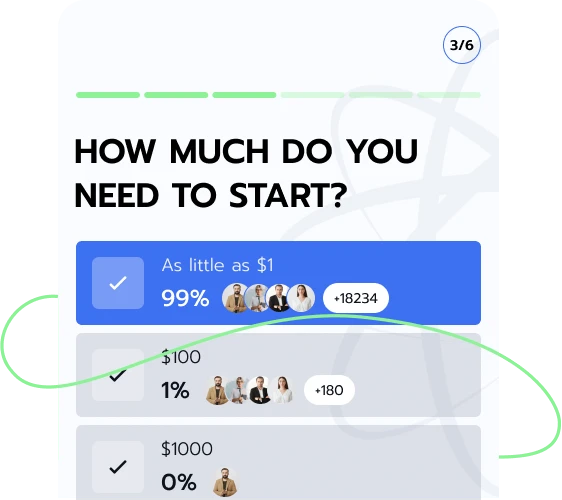

Using Ordolixe is easy and fast. The website is designed to encourage more people to put financial education first. Registration is done by intending learners submitting their names, phone numbers, and email addresses. After signing up, investment teaching websites finalize the connection process via phone by having representatives contact each registrant.

To effect change in the world and investment industry, the Ordolixe team committed its resources to research. The team discovered the lapses in the investment industry, the burning desire for people to get investment education, and the inaccessibility to investment education companies through research.

In the research process, the Ordolixe team, among many issues, realized many people spent several hours searching for investment education companies and were often overwhelmed.

Hence, the team ensured this category of people make up for lost search times, while new learners save time by connecting to investment education companies for free on the Ordolixe. Register and connect for free.

Once people sign up on Ordolixe, the personal information - names, email addresses, and phone numbers - they submit goes directly to investment education firms.

The firms that receive people's details on Ordolixe are those they have been matched with. Connect with an investment education firm on Ordolixe by clicking the button below.

Typing incomplete information like first names only or two of the three information pieces required into the sign-up forms, can cause Ordolixe not to connect people.

When people provide incomplete information during registration, it will be impossible to submit their sign-up forms. Therefore, Ordolixe cannot connect them with investment teaching companies.

Providing incorrect phone numbers and email addresses can alter the connection process. Become one of the millions Ordolixe link daily with investment tutors by registering for free with correct information.

Employing Ordolixe’s help to connect with investment education websites is a highly strategic move. The websites are already sourced and compiled on Ordolixe, and connecting with them only requires a simple, fast, and free registration process. There are no hidden fees too.

Ordolixe’s investment teaching partners are particular about giving each learner a personalized investment learning experience. Connecting through Ordolixe brings investment training based on one’s interests or experiences. From newbies to expert investors, there’s a suitable education for all. Access investment education through Ordolixe by registering for free.

An investment is an asset a person buys or puts money (depending on the asset type). Investors study the market and trends, and consider their risk tolerance, goals, and time horizon before investing. It’s also important to understand that there are no guarantees of success. We discuss some crucial aspects of investment below:

Investments come in different types - bonds, stocks, cash or cash equivalent, and alternatives. These asset types have different features, possible advantages, and disadvantages, which investors consider alongside other factors before choosing. Register on Ordolixe to learn the different types of assets from investment education companies.

Asset allocation is used to select different asset types for a portfolio. In other words, it means selecting diverse assets from each asset type to create a portfolio mix. An investor might buy assets in the stock, bond, cash, or alternatives categories. Want to learn more? Sign up on Ordolixe to connect with investment tutors.

Investment Risks

Investment risk is the tendency for an investment’s gains to differ from expected returns. A huge negative margin between both would mean a big loss.

Investment Strategies

Investment strategies are tactics used to select assets for investing. Some of the strategies include value investing, diversification, and asset allocation.

Risk Analysis

Risk analysis is identifying and analyzing risks that might affect an investment or a company and choosing methods to tackle them.

The components of risk analysis are assessment, management, and communication. Through risk analysis, an investor or company may minimize loss, quantify risks, and preserve resources. Risk analysis can be difficult to perform for certain risks and sometimes underestimates risk magnitude, causing investors to take certain steps with overconfidence.

Investment markets are places where assets are exchanged. The markets also allow for the optimal running of the global economy and smooth capital flow. Investment market types are money, commodities, derivatives, bonds, cryptocurrency, real estate, over-the-counter, stocks, and forex markets. The failure of the investment market can cause unemployment and recession. Learn more about investment by clicking the button below.

Factors affecting investment performance are portfolio management, market trends and cycles, economic conditions, investor behavior, and investment strategy and style. Portfolio management selects, monitors, and rebalances investments to try and improve their performance and avoid risks. Types of portfolio management types are active, passive, discretionary, and non-discretionary.

Market trends and cycles are patterns that indicate performance. Examples of market trends are bear and bull markets. There is a bear market during an extended period of a minimum decline of 20%. A bull market represents a rise in security price by 20% or more. Interest rates, inflation, and growth rates are economic conditions that affect investment performance. An investor may make returns by adjusting a portfolio according to these conditions.

An investor’s behavior can impact their portfolio’s performance. These behaviors include emotional investing, wrong decisions, lack of discipline, or rebalancing incorrectly. Investment strategies may minimize risks and maximize returns. Discover more about investment performance by registering on Ordolixe to learn from investment teachers.

Metrics and ratios used to measure investment performance are the Treynor Ratio, Sharpe Ratio, return on investment, information ratio, Jensen’s Alpha, compound annual growth rate, and Sortino Ratio. The Treynor Ratio is a risk-adjusted metric for determining the excess return on an investment per systematic risk taken. In other words, the ratio compares the performance of investments with all levels of market risk exposure.

Sharpe Ratio measures an investment’s excess return in relation to its downside risk. The ratio is calculated by subtracting the risk-free rate of return (Rf) from the expected portfolio return (Rx) and dividing it by the standard deviation of portfolio return (StdDev Rx). When calculated, a score less than 1 is bad, between 1 and 1.99 is good, from 2 to 2.0 is better, while more than 3 depicts excellence.

ROI calculates the returns generated by an investment relative to its initial cost. To calculate ROI, investors divide their net income by investment costs. The higher the ratio derived, the higher the ROI. ROI calculation is easy and simple to understand but can be manipulated.

Information ratio measures the excess return of an investment relative to a benchmark. To measure this, an investor deducts the benchmark return from the portfolio return and divides it by the tracking error. Information ratio is also applicable to asset allocation and asset management. The ratio is limited because it is based on assumptions and can be misinterpreted.

When Ordolixe connects people to investment tutors, they will discover how Jensen’s Alpha calculates the excess return of an investment compared to its expected return based on market performance and risk level. This metric also determines the viability of portfolio managers’ decisions but is limited as it employs historical data (which does not reveal future performance).

CAGR determines an investment’s average annual growth rate. While CAGR measures past growth, it can also forecast. This metric can be used for early-stage, growth-stage, and mature companies. Want to know more? Register on Ordolixe for free.

Investment performance may be improved after generating low expectations. Some ways to improve investment performance are monitoring/rebalancing/benchmarking, learning from past performance and mistakes, and diversifying. All should first seek an education on these principles.

Monitoring a portfolio can show investors areas that need improvement for rebalancing and benchmarking. Investors can also study past actions to see errors made and the impact on their investments and avoid them in the future. If an investor has concentrated all their resources on one asset/asset type, it may be time to diversify.

Portfolio diversification is the strategy investors use to reduce risks by buying assets across numerous industries, classes, locations, or instruments. Diversification may minimize risks through hedging, reducing volatility, and offsetting losses.

Possible advantages of diversification, aside from minimizing risks, are the liberty to explore other investment strategies, making higher returns, and improving portfolio performance.

On the other hand, it has tax implications, complicates portfolio management, and attracts high costs. Diversification types are time, geographic, industry, risk, asset class, alternative asset, strategy, and industry. Get more details from investment educators by connecting with them on Ordolixe.

Hedge funds is an accredited investor team that pools their money to pursue earnings. These institutional investors use aggressive strategies like leveraging and short positions. While hedge funds may have proficient investors and get increased returns, they are illiquid, charge high fees, and require a huge minimum investment.

Forex market, the most liquid market, is a decentralized platform for people to buy, sell, and hedge different currencies.

Commodities market is the platform for trading physical products like oil, coffee, cocoa, and gold between producers and consumers.

A derivatives market trades financial instruments (options, futures, forwards) that derive their value from underlying instruments (commodities, bonds, stocks, and currencies).

Over-the-counter market is an electronic market where people can trade securities directly (without involving a broker).

A stock market (also equity market) is a platform for investors to buy shares listed by companies aiming to raise capital.

The bond market (also fixed-income market) trades securities issued by the United States Treasury.

Use Ordolixe and gain a new educational status through connection with investment education websites. Engage in thought-provoking conversations and present fresh angles on issues through investment education.

Connect with an investment education firm from the comfort of your home by registering on Ordolixe.

| 🤖 Registration Fee | Zero cost to register |

| 💰 Administrative Fees | Fee-free service |

| 📋 Enrollment Ease | Simple, quick setup |

| 📊 Study Focus | Insights into Digital Currencies, Forex, and Investment Funds |

| 🌎 Country Availability | Available in nearly every country except the US |